Varo Advance 2024-2025

We increased retention at Varo by reducing time to value.

Role

I was the lead designer for this project. I was responsible for Strategy, Product Thinking, UX Design, and Visual Design.

Team

1 Product Designer

1 Content Designer

1 Head of Product

2 Product Managers

8 Engineers

2 Compliance Officers

Timeline

5 months

Problem

We succeeded in acquiring new customers, but we failed to get them to stay.

- People come to Varo interested in Advance

- We require them to set up direct deposit to qualify (~30+ days)

- They don't get what they came for and leave

Goals

We want to help customers get a cash advance as quickly as possible.

Metrics

- Customer satisfaction

- Reduce customer contacts

- Number of new Advance accounts

- Number of new North Star customers

- Plaid link percentage

Solution

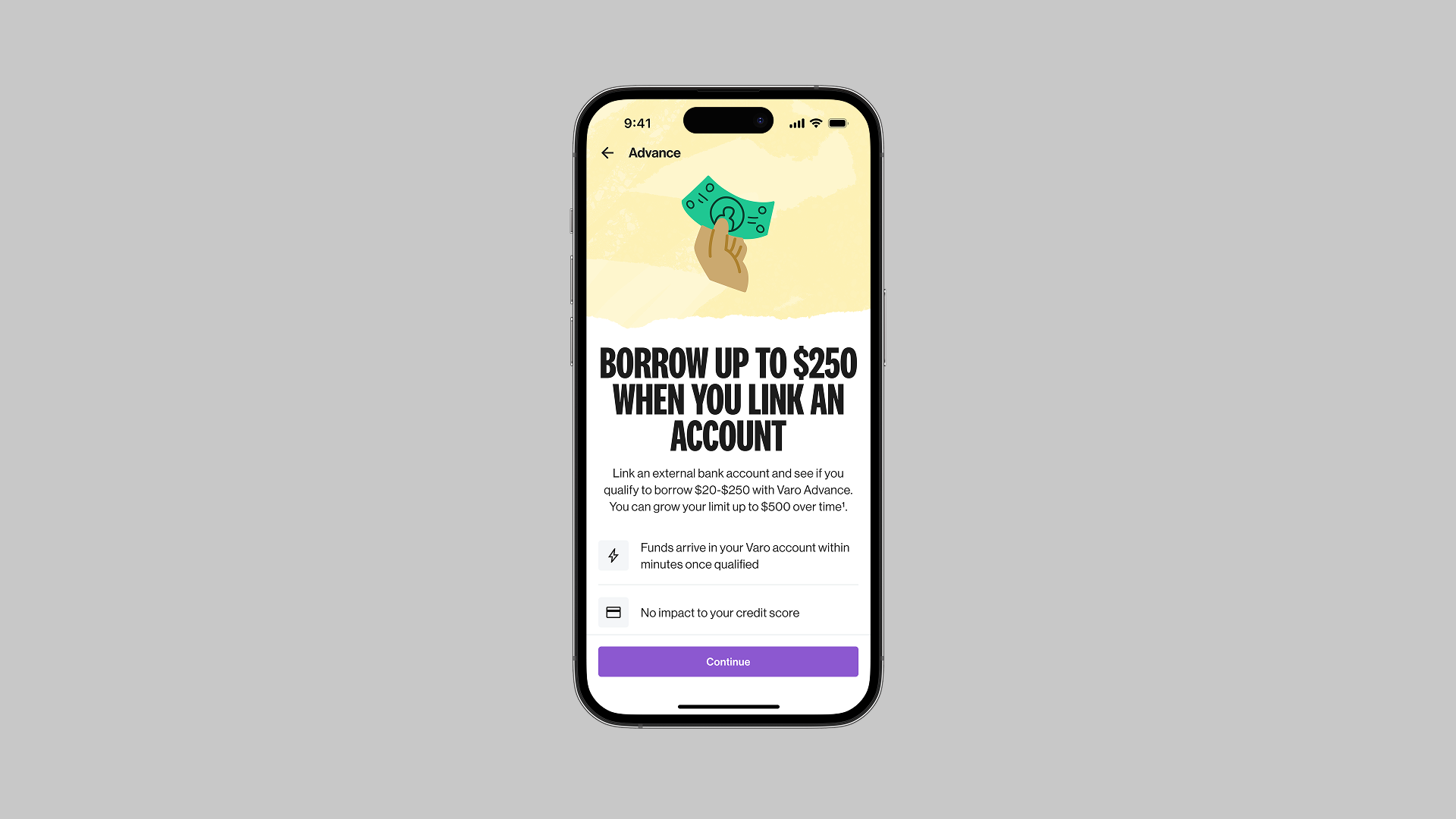

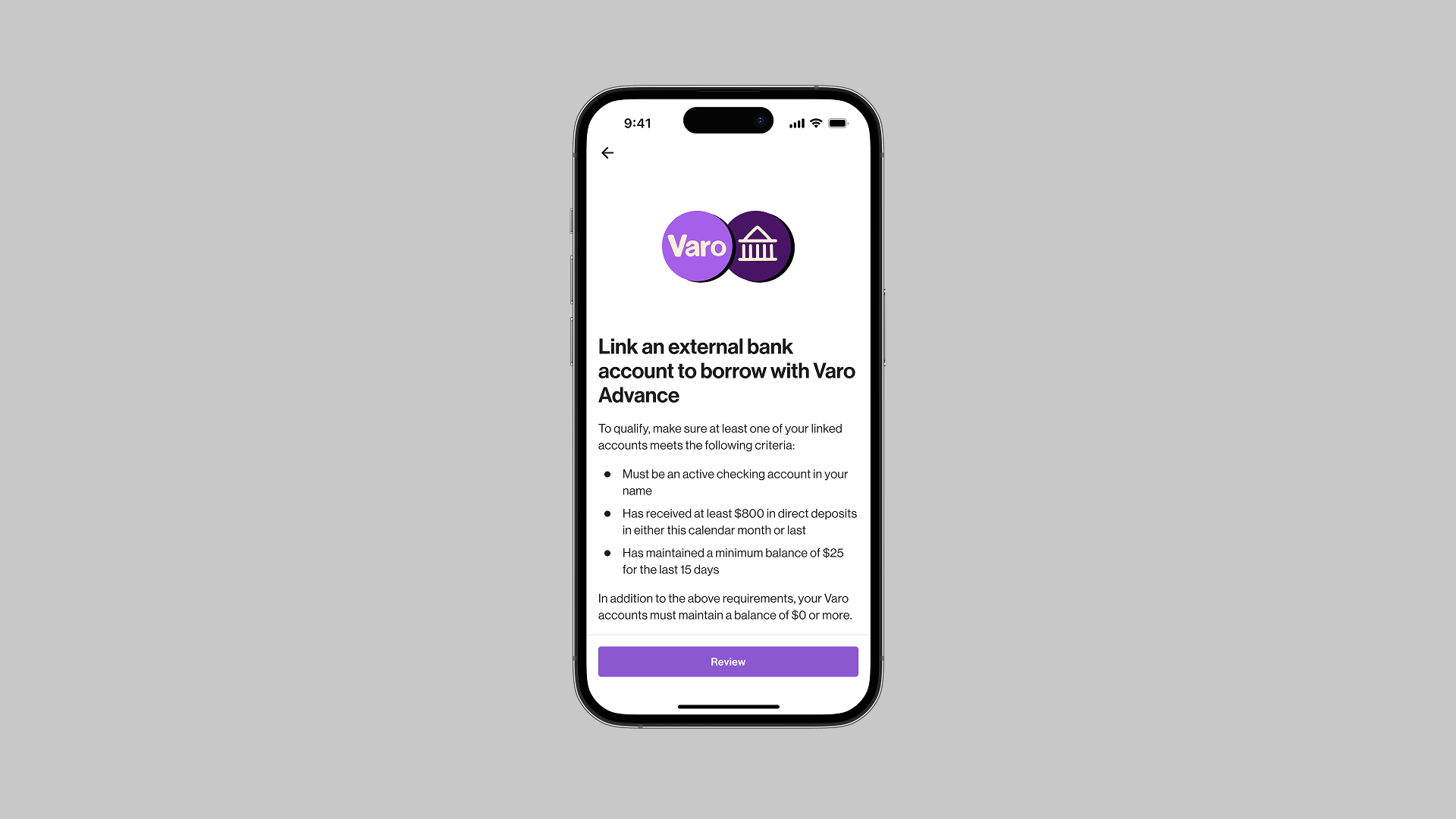

We allow customers to link an external bank account to borrow with Varo Advance.

- People link their bank account with Plaid

- We use the data from their linked account to approve them (same day)

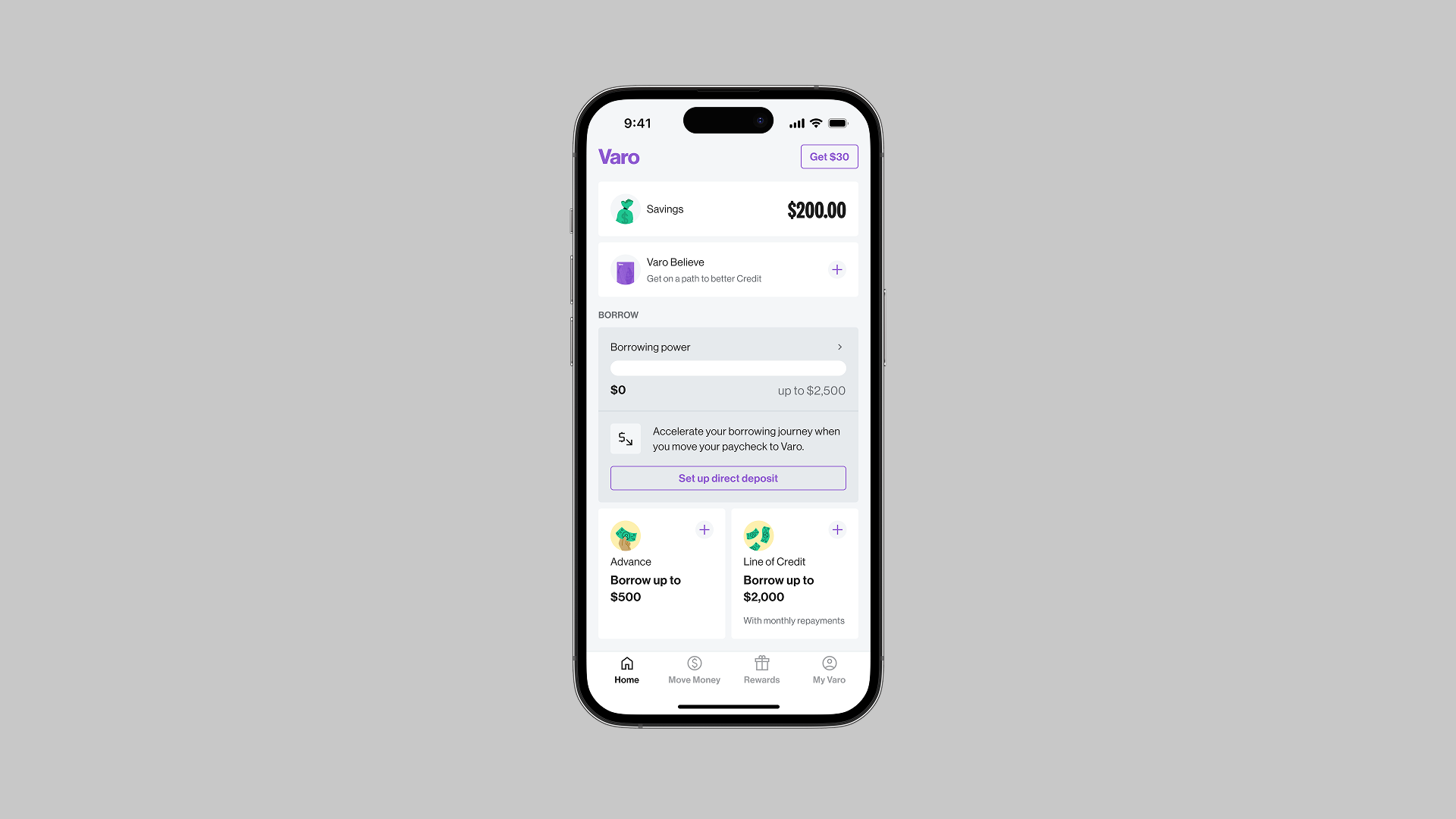

- They can borrow up to $250 by linking an account, and up to $500 by moving their paycheck to Varo

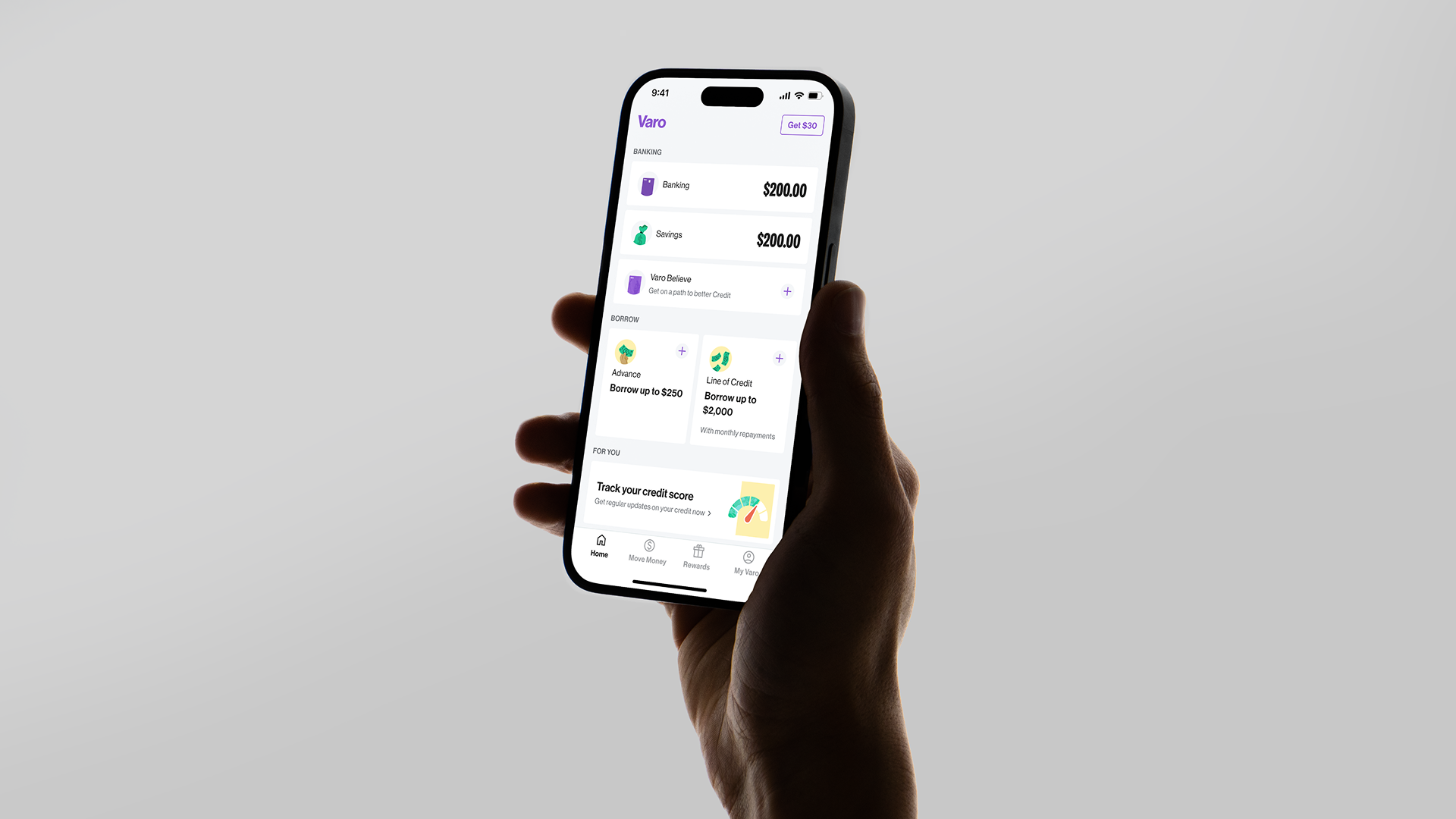

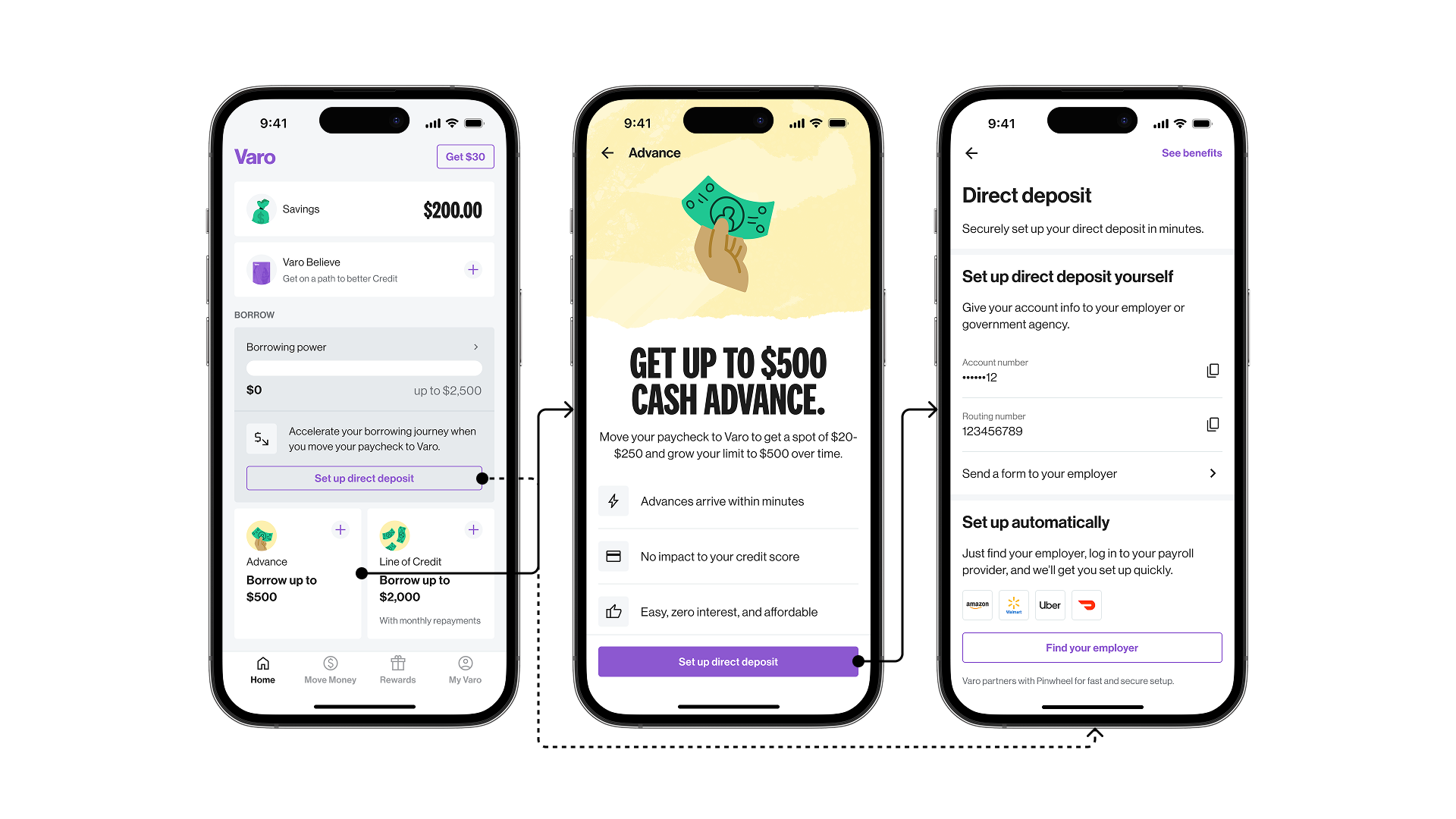

Before

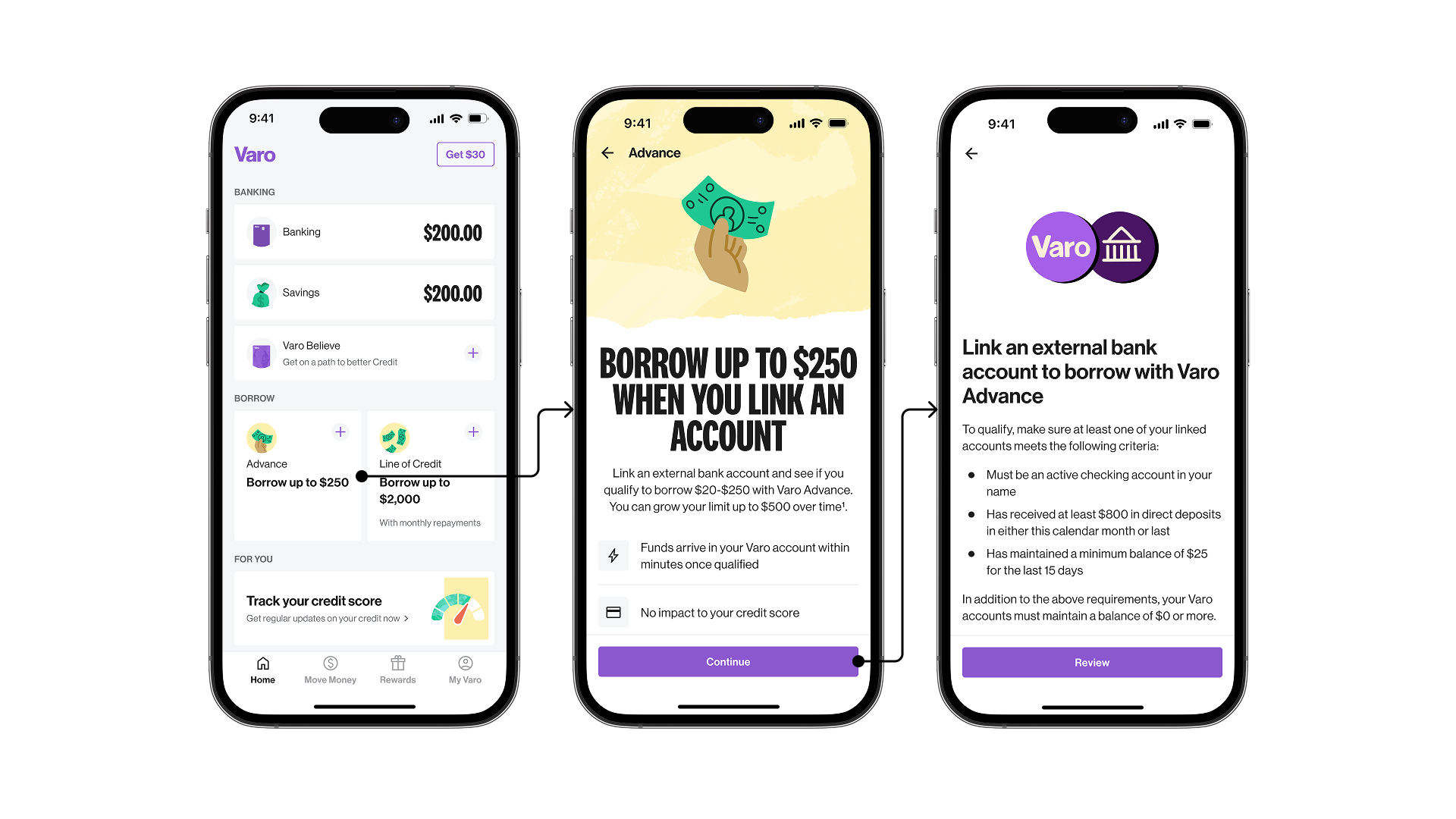

After

Results

We increased customer satisfaction and increased our target metrics.

- We reduced the time to qualify from ~30+ days to within a day

- We reduced customer contacts

- Number of new Advance accounts +21.8%

- Number of new North Star customers +4.8%

- Plaid link percentage 61.3%